Senior Resources Washington

425-922-1613

Receiving Medicare While Still Working

Some people do not take Part B during their Initial Enrollment Period (IEP) because they or their spouse are still working and they have primary insurance from a current employer. You should talk to your employer when you become eligible for Medicare to see how your employer insurance will work with Medicare.

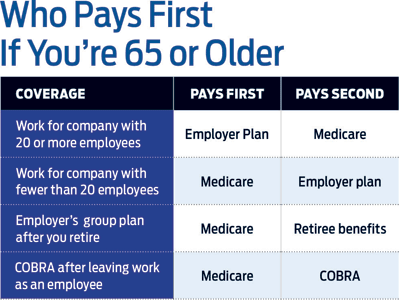

Your Initial Enrollment Period begins three months before your 65th birthday and ends three months after your 65th birthday. If you or your spouse are still working and you receive health insurance from that current employer, the insurance is primary if there are 20 or more employees at the company where you or your spouse work.

If you are already collecting Social Security, you will be automatically enrolled in both Medicare Part A and Part B. You can turn down Part B, but you will need to send back the Medicare card you received in the mail with the form you received stating that you do not want Part B. You will receive a new Medicare card in the mail that does not have Part B on it.

If you are thinking about turning down Part B, you should call the Social Security Administration at 800-772-1213 and ask if you can do that without any penalties.

When you call Social Security it is important to write down whom you spoke to, when you spoke to them and what they said.

If there are fewer than 20 employees at the company where you or your spouse currently work, Medicare is your primary coverage. You should not delay enrollment into Part B. If you decline Part B, you will have no primary insurance, which is usually like having no insurance at all.

If you have insurance from a current employer you qualify for a Special Enrollment Period.

During this period, you can enroll in Part B without penalty.

This Special Enrollment Period allows you to enroll in Part B at anytime while you or your spouse are still working and for up to eight months after you lose your employer coverage or stop working.

It is important to remember that COBRA and retiree insurance are NOT considered current employer insurance, and you will not have a Special Enrollment Period if you have COBRA or retiree insurance. If you have COBRA or retiree insurance and delay enrollment in Part B, you may have to pay a penalty when you go to sign up.

If your work status changes, Medicare may change how it works with your employer insurance. Examples of changes in work status include retiring and taking COBRA. You should also call Social Security when your work status changes.

To learn more about Receiving Medicare While Still Working, fill out the inquiry box to schedule a free consultation.

Copyright 2015 - Senior Resources WA